Payment

Every accountant needs to know which account (sub-account) to account for office supplies in order to correctly maintain

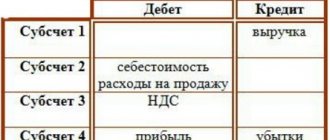

Accounting account 90 is an active-passive “Sales” account, used to reflect information related

General rules for issuing vacation pay Vacation pay represents financial support during vacation. Rely on employees

Registration of payment documents in foreign currency: where to start In order to understand the details

Approved by Decree of the Government of the Russian Federation No. 1 of 01/01/02. Starting from 01/01/17, valid

Administrative liability for tax violations Abstract. This article reflects the main aspects of administrative

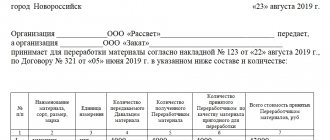

Under what conditions is it possible to transfer customer-supplied materials between the organization that uses the materials and their

“Consultant”, N 12, 2004 RESERVE FOR FUTURE EXPENSES FOR PAYMENT OF HOLIDAYS For even distribution in

The concept of special tax regimes is spelled out in Art. Tax Code of the Russian Federation. They provide a special procedure for determining

Timely payment of taxes is the responsibility of every legal entity and individual conducting business activities. Fine