Payment

As you know, in our country there are several basic and special tax regimes. Entrepreneurs have the right

Home / Labor Law / Personnel Management / Personnel Records Back Published: 08/07/2016 Time

Vehicles may also be subject to additional tax concessions. This program

Financial assistance: taxation 2019 and insurance premiums In most cases, the law does not provide for a specific period

What changes in Russian legislation have occurred since October 1, 2021? Which of them

Changes in accounting for fixed assets in 2021 are associated with the introduction of a new All-Russian classifier

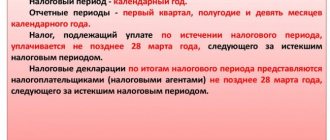

A company can make tax advances either quarterly or monthly. The specific order depends on:

The Russian Ministry of Finance issued Order No. 35n of the Ministry of Finance dated February 28, 2018. It was officially published on April 23

2️⃣ It will become easier to determine how to claim an export deduction From July 1, 2021

Simplified accounting? Simplified reporting! Small businesses have the right not only to conduct simplified accounting,