Payment

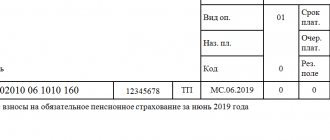

The KBK requisite (budget classification code) is used when making payments in favor of the state budget and

An individual entrepreneur chooses the taxation system when registering his activities and registering with

Accounting for fixed assets at an enterprise in 2021 - 2021 Primarily for specialists

The first step is to calculate the amount paid to the government. There is a difference between individuals and legal entities.

Payers and object of taxation General information Payers of personal income tax are individuals

From January 1, 2021, a new taxation system for

If a company has chosen “income minus expenses” as an object of taxation, then it needs to correctly

Mandatory tax payments Income tax according to general rules is 20% for organizations and

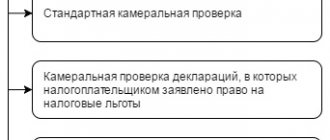

Tax reporting must be submitted on time and compiled without errors: this axiom is firmly known

Briefly about the history of the taxation system in Russia The tax system of the Russian Federation began to take shape after the collapse