Payment

Time sheets were approved in 2001 as primary documents required for

The concept of “taxes and fees” Taxes and fees are mandatory payments to the budget, which

What is basic profitability? The concept of “basic profitability” has been typical since 2021 only for patent

Since the beginning of this year, employers have become obligated to submit information about their employment

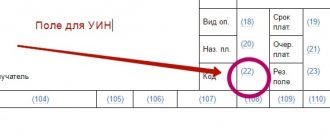

What is a payment order? A payment order is an order drawn up in a document of a certain form from

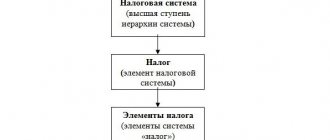

Legal encyclopedia of MIP online - » Tax law » General provisions » Types of taxes

Regardless of the purpose of the payment - state duty, fine or tax - banking structures and

Paying taxes concerns every Russian, but there are categories of citizens who donate money to the budget

The topic of the note sounds like - what is personal income tax in simple words and its decoding. Information

Questions discussed in the material: What are the features of progressive, regressive and proportional tax systems? What is the structure?