Payment

The enterprise profitability indicator EBIT (Earnings Before Interest Tax) or operating profit is an analytical indicator,

Added to bookmarks: 0 Individual entrepreneurship is the most common form of business organization. For physical

“Assets are equal to liabilities”—everyone who begins to get acquainted with management accounting hears these words.

Rented to LLCs and individual entrepreneurs with employees monthly until the 15th day of the following month

Payers of UTII - who pays UTII and how, not all organizations could apply and

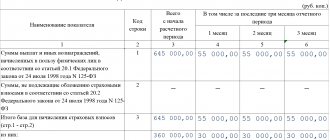

How to fill out the table for calculation? After you have chosen the tax percentage

Accounting: general production expenses During the reporting period, general production expenses are reflected in the debit of the account of the same name

Federal budget taxes Income tax is a very significant fee for any country, not only

Characteristics of accounting account 58 Account 58 in accounting is represented by balance sheet lines 1170

Audio version of the article, listen to 91 accounts in accounting are closed depending on the period: the difference