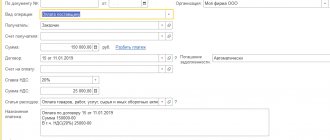

Payment

Determination of the tax base The section of the legislation of the Russian Federation devoted to taxation interprets in detail the concept of tax and

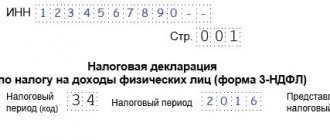

To report to the Federal Tax Service on income for the past year, individuals must use the form

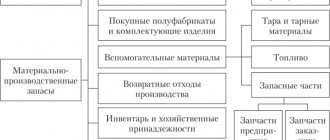

GLAVBUKH-INFO The actual cost of materials purchased for a fee is recognized as the amount of the organization’s actual costs for the acquisition,

Accounting accounts for accounting for finished products Information about manufactured products is stored in account 43

Tax legislation obliges persons who own vehicles to annually accrue and pay tax. Frequency of this

Simplified reporting can be submitted by small businesses, non-profit organizations and participants of the Skolkovo project that are not subject to

Definition of intangible assets Intangible assets are investments in objects without a tangible form in order to

Accounting for the seller. If an organization transfers goods, the ownership of which goes to the buyer

For a detailed step-by-step calculation of advance payments and simplified tax system, you can use this free

Who submits the SZV-M report in 2021 Information must be entered in the SZV-M form