Payment

The accounting reflection of fines in accounting is carried out depending on the type: contractual penalties are accounted for as

Advance report For funds issued to an accountable person, he must report within the prescribed period.

Types of expenses Accounting for existing expenses gives an idea of the cost of manufactured products (work performed).

6-NDFL - reporting of tax agents To increase control over the payment of personal income tax

From March 4, a new procedure for obtaining a deferment (installment plan) for paying taxes and insurance has been in effect.

General rules for individual entrepreneurs and organizations for calculating income tax First of all, to

A limited liability company is a commercial entity created to make a profit. Get yours

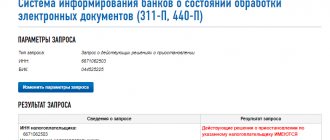

Reasons for blocking a current account by the tax inspectorate As one of the measures to influence

We are often asked how to enter a GPC agreement for the performance of work into the accounting program

The ability to optimize the most complex tax, which is a headache for most organizations in the general taxation system,