Documentation

This article discusses the procedure for filling out the 4-FSS report for the 3rd quarter of 2021

VAT declaration, which implies the basic requirements According to tax legislation on the territory of the Russian Federation

Companies submit Form 4-FSS to the FSS office of the Russian Federation at the place of their registration in the following

Who must report on the single tax on imputed income for the 3rd quarter of 2021

For companies on the general taxation system, the main budget payment is income tax. Report

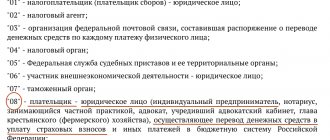

The transfer of administration of insurance premiums to the Federal Tax Service has raised many questions. One of the most relevant: what is the status

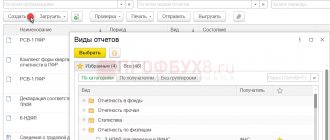

Creating a new 6-NDFL report and filling out the title page To create a 6-NDFL, open 1C: Reporting

What kind of preferences were offered to small businesses this year so that they survive and

According to the Tax Code of the Russian Federation, individuals receiving income in Russia are required to pay personal income tax from

Submitting reports to the Federal Tax Service You can submit reports to the tax office on paper or electronically