Documentation

On October 1, 2011, paragraph 3 of Article 168 of the Tax Code came into force

"TORG-4" is the primary accounting document that is accessed when the ordered products are delivered to

Who should flash the KUDiR The book of income and expenses is kept by individual entrepreneurs on OSNO, USN, Unified Agricultural Tax

Line of the financial results statement Return back to Financial result On line 2110 “Revenue”

The essence and purpose of the document In the activities of any entity there are an innumerable number of different forms, types,

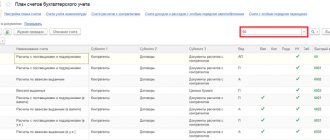

Turnover on account 60 and its application in accounting Account 62 “Settlements with

Why do you need a 2-NDFL certificate? The certificate may be needed by tax agents, individuals, individual

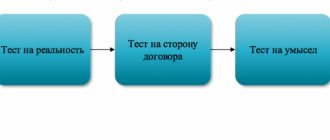

What to do if the tax office suspects your counterparty of dishonesty? For example, it can be counted

When is severance pay reflected in the 2-NDFL certificate? Since the dismissal benefit is material

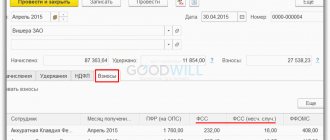

How FSS contributions are calculated in 1C Tariff for automatic calculation and calculation of contributions