Documentation

General rules for filing a declaration As Article 174 of the Tax Code shows, the declaration is submitted after

In accordance with paragraph 2 of article 431 of the Tax Code of the Russian Federation and part 2 of article

Sickness benefits paid by an employer to its employees fall under income that is subject to personal income tax. Transfer tax

Information on income tax is reflected by tax agents in 2-NDFL certificates and 6-NDFL calculations. These

Two news - good and bad. The good news is that, as a rule, Russian

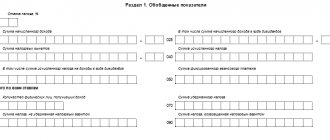

Reliability.. This is a sheet with summary information, which is filled out last, when the

Changes in the content of the document From the 2021 calendar year, reporting acts for 2021 are submitted

A balance sheet is a document characterizing the financial position of an enterprise as of a specific date. Displays assets and

10 questions and answers about tax deductions when buying real estate The solution to the housing problem is inevitable

Who is required to submit a declaration and in what form? VAT return for 3