Deduction

» Maintaining an individual entrepreneur » Patent Individual entrepreneurial activity is always associated with clear rules that

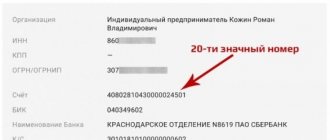

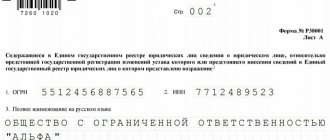

Each company that is registered as an individual entrepreneur or LLC has a bank account, and

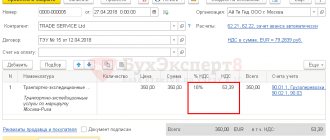

In accordance with paragraph 1 of Article 164 of the Tax Code of the Russian Federation, a zero VAT rate can be applied

VAT Declaration Income Tax Declaration Corporate Property Tax Declaration

In accordance with the current legislation of the Russian Federation, economic entities required to maintain accounting records submit annual

Recently, tax authorities have been actively checking organizations. A fight is being waged against unscrupulous companies, namely

What is a payment order? A payment order is an order from the payer to his chosen bank, established

Legislation on the transition to direct payments Transition to direct payment from the Social Insurance Fund for social payments,

What is accounts receivable? The work of any organization is associated with the occurrence of debt. She comes in two

Who can be transferred to remote work? Representatives of not all professions can be “removed.” But