The deadline for submitting annual accounting (financial) statements for 2021 is approaching. In what cases does

The role of value added tax in the Russian Federation Value added tax is indirect

On November 15, 2021, the law on self-employed people was approved by the State Duma. Officials guaranteed conditions would not worsen

Who submits the income tax return for the 3rd quarter? The income tax return

Who must report on the single tax on imputed income for the 3rd quarter of 2021

Companies submit Form 4-FSS to the FSS office of the Russian Federation at the place of their registration in the following

The law establishes minimum maternity payments in 2021. As a general rule, they are determined by

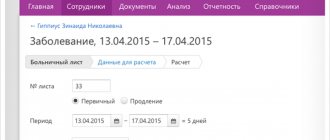

In what order to calculate sick leave benefits To calculate the amount of sick leave benefits, you need to determine: calculated

What is a self-employed person in the understanding of the tax code? What is “self-employment” in simple words? This

From the beginning of 2021, statistical authorities will oblige the small business sector to report using updated forms