Absolutely all employers who have concluded labor and civil law contracts with employees (and these

In what case can the Federal Tax Service initiate the tax audit process? Let's talk a little about the foundations of the Federal Tax Service

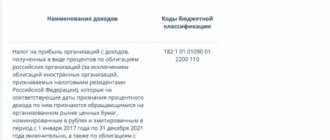

What is a tax benefit? In the legislation of the Russian Federation there is no clear interpretation of the concept of “tax benefit”. That's why

On the territory of the Russian Federation, the document serving as the basis for the transfer of funds by banks is the payment document.

Any financial and economic transaction in the activities of the company is reflected in the accounting accounts. All

Basic rules for deducting and recovering VAT Regarding goods received by the VAT payer

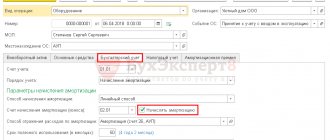

Depreciable property Depreciable property is fixed assets (fixed assets) and intangible assets (IF) available

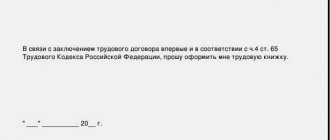

Date of publication 01/28/2020 In accordance with the amendments made to the Labor Code of the Russian Federation by the Federal Law dated

The year 2021 was marked for the accountant by the cancellation of the report on the average number of employees, which was submitted by enterprises

Payment to bailiffs (sample) For a person who lost a case with financial consequences in a court hearing, Federal