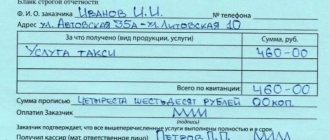

How to fill out the BSO for a taxi depends on how the driver works. Taxi drivers from the state

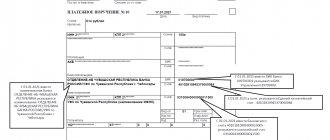

Before submitting a VAT return, each accountant must ensure the accuracy of the invoice data,

The rules for accounting for securities are specified in the chart of accounts No. 94n. They must be taken into account

Individual entrepreneur – VAT In accordance with clause 1 of stat. 163 Tax Code individual entrepreneur

The concept of SNT SNT (garden non-profit partnership) is a non-profit structure established on a voluntary basis with

Form 3-F for Rosstat In 2021, a new form of Form 3-F was introduced

Management reports, their purpose Distinctive features of management reporting from conventional accounting Financial analysis and

New online cash registers have been used by most retailers since July 2021

From January 1, 2021, the details for paying taxes will change. The main change concerns individual

The inspectorate often decides to suspend on-site tax audits. This means that the calculation stops