Who fires the CEO of an LLC? The head of the organization acts as an executive body representing its interests and managing

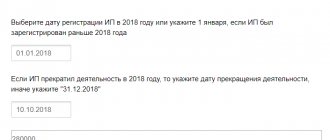

Taxation of individual entrepreneurs in 2021 is the procedure for interaction between an entrepreneur and the tax service. From

Inventory, as one of the tools for monitoring the state of material assets in an organization, allows you to immediately identify

The current state of affairs in our country is such that not every physical, as well as

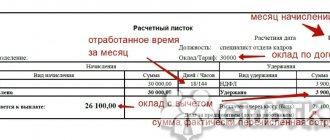

It is the responsibility of employers to notify employees of the amount of accrued wages and deductions made.

A citizen who pays personal income tax at the usual rate of 13% has the right to use the standard tax deductions provided for

Unilateral settlement is permitted by Art. 410 of the Civil Code of the Russian Federation. The legislator has provided for this

Requirements The application must comply with these standards: The information presented in the paper must be truthful. Should

Settlement between organizations Settlement between two legal entities is possible only with the consent of both parties. Opportunity

Any business activity involves expenses. You have to spend money on various processes and purchases: necessary for