Who should flash the KUDiR The book of income and expenses is kept by individual entrepreneurs on OSNO, USN, Unified Agricultural Tax

Tax accounting according to the Tax Code of the Russian Federation Tax accounting data for a Russian taxpayer must reflect, in

When a company offers food to customers, it should always automate its business, in any format

For most companies, getting employees to their place of work is often problematic. Employer location

All enterprises must make tax payments to budgets of various levels. In the Russian Federation there are several

Account type: Active Calculation, inventory. Procedure and accounting of results Your Mail Password Register.

Author: Alena Donmezova - RKO Specialist Date of publication: 04/22/2021 Current as of May 2021

Line of the financial results statement Return back to Financial result On line 2110 “Revenue”

, , “” . . 3 . 154 . , “” , . 2

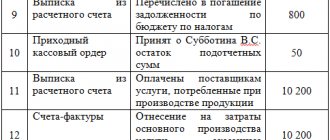

Direct and indirect costs: what are they? According to Art. 318 Tax Code of the Russian Federation production costs