Video surveillance as an additional service is paid for by the owners according to the methodology adopted at OSS. A turning point in the case has occurred

The binary system and the essence of double entry At first glance, concepts such as the binary system

In order to understand how to work and use a special account, it is enough to have a general understanding of

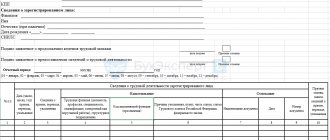

Who is required to submit a report Reporting forms for property fiscal tax are provided by organizations recognized as taxpayers

Author: Maxim Potashev While the Russian economy is hitting one bottom after another, the situation of workers is becoming

Types of securities In accounting for the purposes of revaluation, securities are divided into: financial investments,

Return of goods in 2021. According to the recommendations of the tax office, in any case of returns, it is necessary to apply

Checklist: stages of preparing and conducting a special assessment Stage 1. Create a commission to conduct a special assessment

When providing information, starting from 2002, the policyholder (employer) fills out: form SZV-4-1 when providing

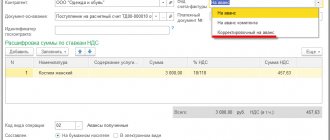

Indirect expenses in 1C Depreciation expenses Improvement of rental property Travel expenses Payment in