Payment

Basic requirements for organizing accounting in 2014 Today we can highlight the following:

Excise taxes and VAT are one of the key concepts for economists dealing with the peculiarities of

What does Article 112 of the Tax Code allow? A list of mitigating circumstances that will allow a company or individual entrepreneur

What is a GPC agreement and what are they like? When among two or more persons

What is a tax offense and responsibility for it? A tax offense is actions that

As practice shows, when making various transactions, oral agreements are not enough. Especially in those

An organization can pay employees not only under an employment contract, but also under a civil law contract.

When we actively use a bank card, a lot of various operations (transactions) go through its account.

The work of any enterprise involves reflecting the operations performed. For this purpose, a Chart of Accounts is created. He

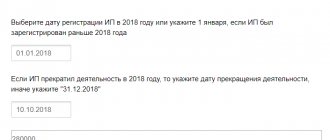

Taxation of individual entrepreneurs in 2021 is the procedure for interaction between an entrepreneur and the tax service. From