Payment

We will look at when tax authorities conduct a repeat tax audit. First you should know that

Methods for calculating depreciation Accounting has four options for calculating depreciation. Learn more about the methods

In the Social Insurance Fund Quarterly By the 20th day of the month following the reporting period. \r\n\r\n

Author: Ivan Ivanov Accounting is one of the most precise theoretical and applied sciences, thanks to which

Although deadlines for filing tax returns and paying some taxes have been extended to 17

What exactly is the problem and what risks does it pose? More than 20 years ago

09/24/2019 When registering an individual entrepreneur, one OKVED code (all-Russian classifier of types of economic activities) is selected in

⭐ ⭐ ⭐ ⭐ ⭐ Legal topics are very complex but, in this article, we

Withhold the amount of material damage from the employee’s income in this order. First calculate the amount of losses,

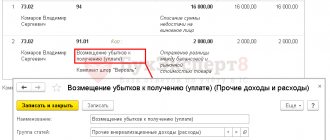

1. Dividends and their policy 2. What is leverage? 3. Income and expenses of others