Payment

What kind of report? Previously, you submitted RSV-1 and 4-FSS reports to the pension fund and

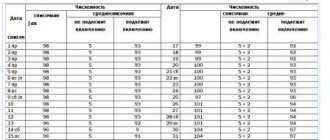

The country's tax legislation establishes the obligation of all employers to annually report on the average number of personnel employed

A number of professions are closely related to the need for employees to perform their labor functions out of place

Filling out 6-NDFL when changing tax residence Tax residents are individuals who are not actually located in the Russian Federation

For individual entrepreneurs using PSNO, the object of taxation is potentially receivable

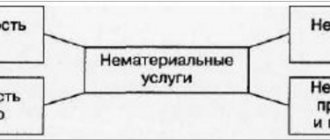

Accounting for third party services Third party services are a type of activity that is not

Expenses to combat coronavirus This is a new type of expense that appeared in 2021.

Accounts receivable. Competent control, planning and management The downside of sales growth is almost always

Unified agricultural tax: what kind of taxation system is this? Unified agricultural tax is a system that

Refusal to maintain a book of income and expenses is possible only for those individual entrepreneurs and