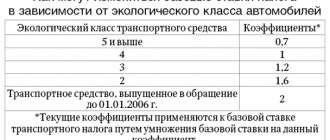

General information about tax The tax in question is imputed, that is, it does not depend on the size

The personal income tax return 3-NDFL is submitted to the Federal Tax Service by entrepreneurs who do not apply tax

Excise goods Excise tax is established, as a rule, for special categories of goods that: either are extremely profitable

What is accounting policy Accounting and tax legislation is not always strict and imperative

For what reason may the FSS of Russia refuse compensation? Employees of the FSS of Russia have the right

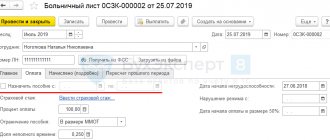

Parental leave is granted upon application and can be used in full or

Deadlines for submitting LLC reports to OSNO in the 3rd quarter of 2018. Report name Frequency

Environmental fee for manufacturers and importers of packaged goods. Paragraph two of the data clarifies the procedure

There are only three months left before the mandatory transition to online cash registers. Registered today with the Federal Tax Service

New criteria for fixed assets The federal standard does not replace Instruction No. 157n (as amended by