Cash settlement limits between legal entities and individuals in 2021 relate to the area

When working on holidays, monetary compensation is provided, and a subordinate can also choose double pay

What is meant by “exemption” from the use of cash register equipment? Indeed, “exemption” from the use of CCP may

Each simplified tax system payer, be it a company or a businessman, pays a single tax based on the requirements defined

Over the past couple of years, the media have regularly been circulating stories about personal income tax: supposedly from every transfer that

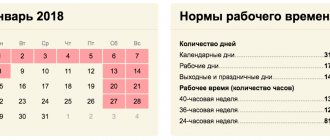

Welcome to the 2021 calendar page! Only on our website is the most complete version presented

Income tax on dividends paid to Russian organizations Get personal advice from Katerina Vasenova at

No later than May 2, 2021, entrepreneurs submit 3-NDFL to the inspectorate. We brought for

Zero personal income tax reporting for individual entrepreneurs Individual entrepreneurs without employees do not submit personal income tax reporting to

For LLCs with and without employees Date Reporting form and payments Tax regimes Where