Do I need to pay? Let us repeat, personal income tax in our country is 13%. This tax also applies

The probationary clause is not mandatory, but an additional clause in the content of the employment contract, as well as

Travel log: is it necessary to keep it? Most organizations use vehicles. But

Fixed contributions Let's take for example an individual entrepreneur who pays only the minimum fixed contributions established by the state.

How to select OKVED codes for individual entrepreneurs The OKVED classifier is a reference book containing several sections.

Regulatory framework for primary documents To reflect any business transaction in accounting it is necessary

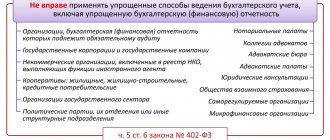

Criteria for small enterprises for 2020-2021 Every company is required to draw up a balance sheet. But the right

How to convert currency in 1C? When an organization works with foreign counterparties, it has to

What is the procedure for calculating vacation pay for an incomplete year and month worked? In HR practice

If the founders of the LLC are individuals, then income in the form of dividends received from the business