Payment

In 2021, there will be no significant amendments to the Tax Code of the Russian Federation regarding work with income tax

On this issue, we adhere to the following position: The employer has the right to keep a time sheet

MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION INFORMATION NOTICE dated May 28, 2021 N IS-accounting-18 By Order

Budget classification codes are used by all entrepreneurs and organizations. BCCs for paying taxes consist of

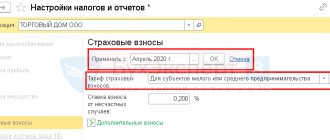

Who can apply the reduced contribution rate During 2017–2018, those employed in production

The property deflator coefficient for taxation of real estate owned by individuals is applied until 2020.

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

A new billing period has arrived. In this article we will tell you what you need to pay attention to

Purchasing a vehicle on lease allows an individual or organization to rent a car

The activities of any organization involve costs not only for the manufacture of products, provision of services or