Documentation

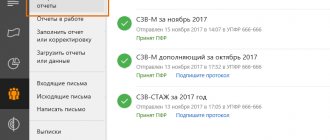

In February 2021, all employers will have to submit the SZV-TD form to the Pension Fund for the first time,

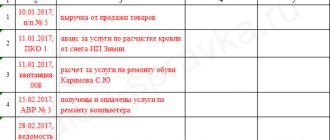

KUDiR: what is this in simple words KUDiR: what is it? The decoding is as follows: income accounting book

Question for the auditor Joint-stock companies have been removed from the list of organizations that are subject to mandatory audit. They fall under

Why do you need statistics form No. 5-Z? The form in question is a statistical reporting document and should

Hello, Vasily Zhdanov is here, in this article we will look at the long-term liabilities of an enterprise. The concept of passive (from

The law allows an individual entrepreneur to receive a discount on the insurance rate for premiums for injuries. Expensive

One of the options for drawing up a 3-NDFL declaration is to use a free program, which can be downloaded at

Hello! In this article we will tell you why a 2-NDFL certificate is required at a new place of work.

Current as of February 13, 2021 If the overpayment was due to pension, medical or compulsory social benefits

In sheet 02 of the declaration you determine the tax base, indicate the tax rates, calculate the tax and