Deduction

Subordinate to the “Materials” account (10). Account type: Active. Account type: Quantitative Tax Analytics

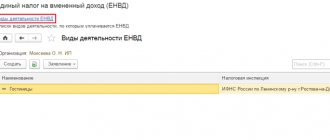

Federal Law-54 Online cash register for UTII and Patent The information on the site is kept up to date.

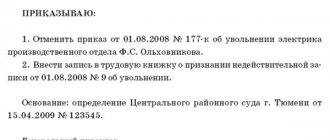

Reasons for dismissal of the general director At the initiative of the employer, regardless of the actions performed by the manager.

In accordance with subparagraph 22 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation, to other

For women working under employment contracts whose work experience is more than 6 months, benefits are accrued in

Support for children and their parents New benefits for single-parent families and pregnant women have been introduced

When deciding to start a business, many beginners do not think through the financial issue. But in vain. IN

A bank account is no longer an indicator of the owner’s wealth, but simply a convenient tool

The concept of BSO First, it’s worth understanding what a strict reporting form is. Is not

Tax base Determine the tax base in accordance with Articles 154–159, 161–162 of the Tax Code of the Russian Federation.