Deduction

The article will discuss how the bankruptcy of legal entities by the tax inspectorate proceeds.

The UTII declaration for the 3rd quarter of 2021 has been changed, the new template recommended by tax authorities is given in

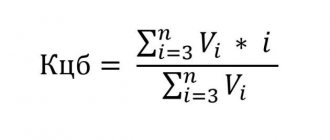

Introductory information The budget classification code (BCC) is included in the group of details that allow you to determine ownership

UTII is one of the most popular taxation systems for retail trade and other types of

Tax officials have the right to request documents necessary for verification from the company itself (clause 1 of article 93

Workplaces with computers, copying equipment, and household appliances are officially exempt from certification.

Organizations must prepare financial statements based on the results of 2021. Accounting (financial) statements for 2021

What is an investment tax deduction? An investment tax deduction is an amount with which some

Income tax Income tax is paid to the federal and regional budgets.

On July 1, 2021, new amendments to the law “On CCP” will come into force.