What should an accountant do to prepare for the new payment procedure? What nuances need to be taken into account

On what form should the UTII declaration be submitted? Are there any changes to the form?

On the income of hired personnel and personal income tax withheld from these amounts, tax agents, incl.

When carrying out delivery and peddling retail trade, persons wishing to switch to paying a single tax

Who pays the minimum tax At the end of each year, all individual entrepreneurs and organizations use the simplified tax system

Source: Magazine “VAT Problems and Solutions” Who deals with taxable and non-taxable

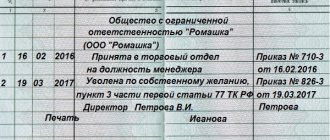

Despite the abundance of explanations, it is necessary to correctly record the dismissal in the work book and electronic

OSNO companies pay tax on their profits in installments throughout the year. When is the year

Reflection of transactions with penalty amounts in the accounting of government institutions has its own characteristics depending on

The contents of line 130 in form 6-NDFL Line 130 causes confusion even for an experienced accountant.