Federal Tax Service of Russia dated June 10, 2020 N BS-4-11/9607 MINISTRY OF FINANCE OF THE RUSSIAN FEDERATION FEDERAL TAX SERVICE LETTER

Apply for participation in the online seminar → During the period of relative calm between the annual and

Amount of insurance premiums for 2018-2021 From 2021, the procedure for calculating fixed contributions will change

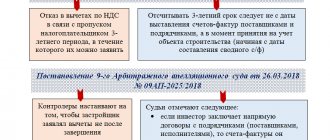

How to decipher the term “consolidated invoice” There is no official decoding of this concept. In general

Statements by government agencies about reducing pressure on business, reducing the number of control measures regarding

The procedure for calculating depreciation of fixed assets in accounting Depreciation involves the gradual inclusion of costs in expenses

The Tax Code prohibits organizations from taking into account in expenses the cost of acquired fixed assets (fixed assets) at a time.

What role do deposits play for legal entities? First of all, it brings additional

Introductory information General provisions regarding changes in the calculation of RSV-1 are contained in Article 17 of the Federal Law

A software application recommended by the Pension Fund of the Russian Federation for monitoring reporting and other documents sent to