Tax preparers monitor the financial activities of each company or individual entrepreneur. They have to

In this article, we will look together at a situation in which an IT company is trying to figure out at what point it

Changes in wages and personal income tax From 2021, the minimum wage is expected to be 9

What is a sliding schedule according to the Labor Code of the Russian Federation? You should immediately note that the standards of the Labor Code

Deadline for payment of personal income tax upon dismissal in 2021 The article is current as of: January 2021

What is the 2-MP innovation form and in what time frame does it need to be submitted? The form is presented

Procedure for filling out the Declaration includes: title page; Section 1 “Amount of tax to be paid

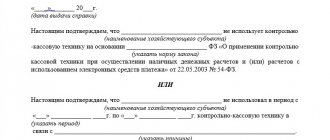

Author: Ivan Ivanov Every citizen who has decided to carry out entrepreneurial activities is obliged to use

What is the reporting form? Report form P (services) - statistical, code by

Legal encyclopedia of MIP online - » Tax law » Payment of taxes and fees »