Payment

Modern economic reality is such that counterparties and organizations themselves are not always conscientious payers

Educational program for those who want to understand this profitable tax system. Moreover, soon

Examples to help you understand the dates and rates for personal income tax. Personal income tax applies to

From 01/01/2015, a new procedure for calculating property tax for individuals was introduced based on the cadastral

Employees of the Ministry of Labor in Letter dated August 15, 2016 No. 16-5/B-421[1] recommended the form of a certificate of average earnings for

What are temporary tax differences (TDT)? PBU gives us the answer to this question

L. M. Zolina author of the article, Ascon consultant on accounting and taxation Wording clause.

What is an organization’s equity capital? This is a financial indicator that characterizes the amount of funds owned by participants

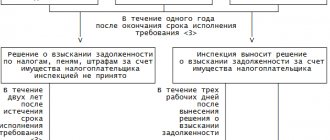

Legal encyclopedia of MIP online - » Tax law » Payment of taxes and fees »

Each tax must be paid by the organization on time. This rule applies not only to