Documentation

There are several options for transferring wages to bank cards: within the framework of a salary project -

Step-by-step instructions The organization entered into an export contract with a foreign buyer LadystyleKz (Kazakhstan) for the supply of non-raw materials

At first glance, resolving the problem is not difficult. To do this, it is enough to include in the contract with the supplier

Insurance premiums from the Social Insurance Fund against accidents Pavel Andreev Journalist, assistant editor Insurance premiums –

Introductory information General provisions regarding changes in the calculation of RSV-1 are contained in Article 17 of the Federal Law

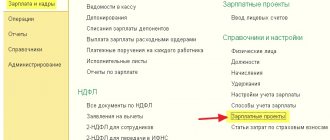

06/25/2017 The 1C 8.3 Accounting 3.0 program has some functionality for maintaining personnel records

There are often situations when an accountant, having made adjustments to the payment of wages by manual entry, then

Tariffs for insurance premiums in 2021 In the Pension Fund of the Russian Federation - 22% for payments

Legislative rationale The document regulating inspections is the Regulation on the procedure for conducting cash transactions No. 373-P,

An individual taxpayer number (TIN) is assigned to each individual or organization or institution that is required to pay