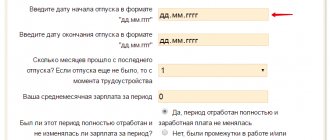

What is vacation pay? During the vacation, an official employee of the company is completely exempt from performing labor duties.

It is important to find out in advance the deadline for filing a tax return for individual entrepreneurs in 2018, so as not to anger

What is an advance payment Advance payment is an advance payment of tax, calculated based on the tax base

Starting with reporting for the 1st quarter of 2021, a new form of the Calculation report will be used

Form 4-FSS in 2021 If previously the 4-FSS report was intended for all insurance premiums,

29. Why is income tax so important and what else is interesting? RK at the legislative level

From January 1, 2021, all insurance premiums must be sent to the Federal Tax Service, with the exception of

Reserves for doubtful debts: accounting and tax accounting Reserves for doubtful debts are also formed in accounting,

The process of filling out documentation is not easy. In this article you will learn how to correctly fill out 3-NDFL for

Types of reporting for individual entrepreneurs In 2021, individual entrepreneurs must report to the following organizations: Tax