Legal Entity Taxpayer Program 2021 The service is designed to automate the process of generating tax reporting and other documents.

Position of official departments The ambiguity in the accruals was due to the fact that the regulatory documents do not contain

Let's consider situations where your own products or purchased goods have expired. When reflected

Author: Ivan Ivanov When carrying out work activities in organizations, enterprises and companies, it is often necessary to compile

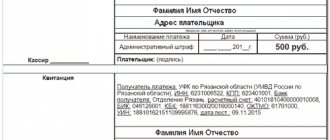

The article describes the CBC for monetary penalties - fines in 2021 for non-compliance with standards

Russian legislation provides for the possibility of borrowing not only money, but also various goods.

Currently, when working with foreign freelancers, it is possible to use services that provide

The ratio of accrued and written-off tax The greatest suspicion is caused by taxpayers whose accounts are credited with a large

Receipt of a bill of exchange from a buyer When receiving a bill of exchange in payment for goods (work, services)

Procedure for accounting for expenses for income tax purposes Date of publication: 03/02/2016 12:53 (archive) Article