Payment

Code at the place of UTII registration for Russian legal entities For Russian companies the following are provided:

Land tax is always classified as local taxes. It is obligatory to pay where

Who should use FSBU 5/2019 and how? From the point of view of applying FSBU 5/2019, everything

Good afternoon, dear subscribers! We remind you that in addition to this newsletter, our team also conducts

Transport tax rate in St. Petersburg The transport tax rate is determined by regional authorities in their own way

Definition Liabilities are one of three sections of the balance sheet in addition to assets

Late payments Reporting on accrued and paid contributions is submitted in Form 4-FSS. Deadline

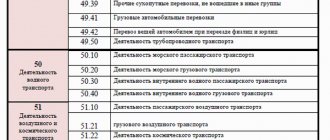

Types of transport services for the transportation of goods Transport services by type are divided into several categories.

Reporting in 2021 From January 1, 2021, you need to take into account some changes in

What are dividends It is difficult to argue with the fact that each of us wants in addition to the basic,