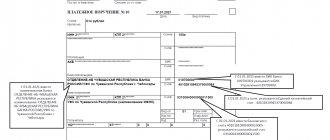

Payment

The concept of SNT SNT (garden non-profit partnership) is a non-profit structure established on a voluntary basis with

Individual entrepreneur – VAT In accordance with clause 1 of stat. 163 Tax Code individual entrepreneur

New online cash registers have been used by most retailers since July 2021

From January 1, 2021, the details for paying taxes will change. The main change concerns individual

The inspectorate often decides to suspend on-site tax audits. This means that the calculation stops

The second party did not receive a statement of set-off Even in situations where the parties set off the counter,

The procedure for documenting services To confirm the fact of agreement on conditions, it is necessary to conclude an agreement between the parties

Hello, Vasily Zhdanov, in this article we will consider the revaluation of non-current assets and their calculation

A little theory Today we are looking at a topic in which the terms “costs and expenses” are constantly encountered,

The write-off of an asset is not always associated with the end of its useful life. The reason for the withdrawal of non-current